Legal Assistance with Tax Sales

Tax Lien properties are an AMAZING opportunity in Indiana.

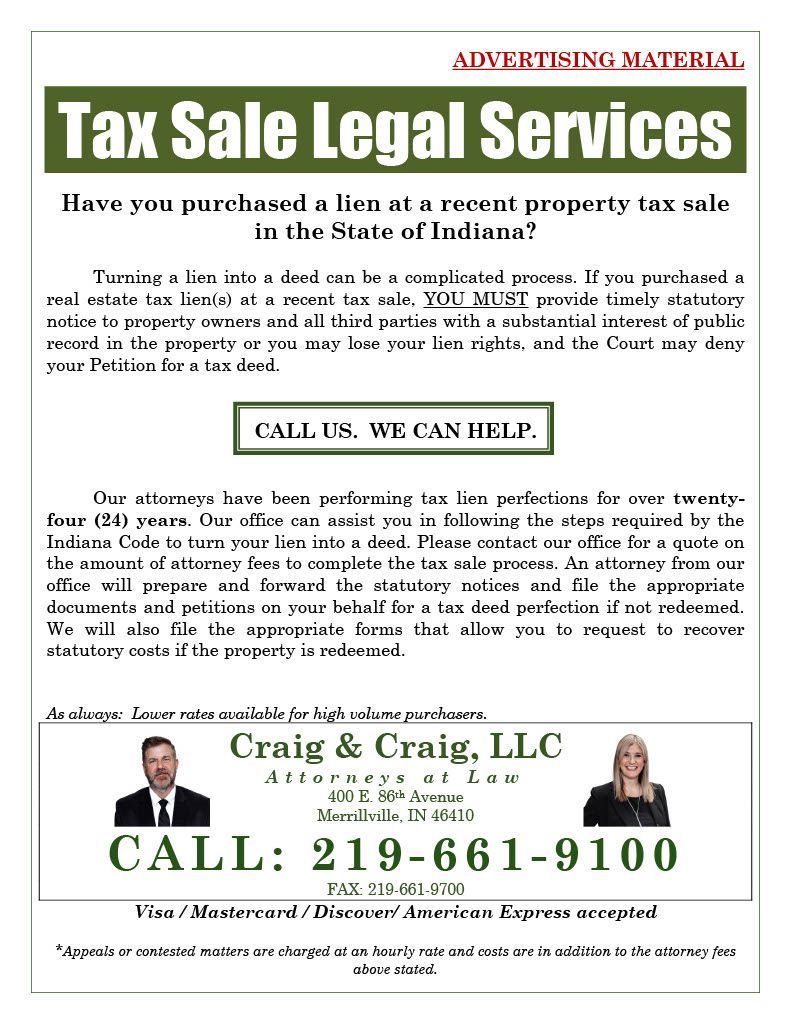

Our firm has over 45 years of combined experience in Tax Lien perfection to ensure statutory compliance to get a tax deed are taken!

- INVESTIGATE WHAT YOU ARE BUYING BEFORE YOU BUY!

- Hire a legal representative to help you through the process. Watch out for the "cheap" attorney. Tax Lien perfection is unique and critical in that the cases and statutes are followed. Inexperienced counsel could cause you to lose what you purchased.

- Fill out all presale Auction forms completely and thoroughly.

- Notices to parties MUST be sent out after you purchase the lien from the Auction. You don't just own the property. You only have a lien until it is perfected, and that's IF you get all the paperwork and notices correct and on time.

- Missed notice deadlines after you purchase a lien are fatal and can cause you to lose your lien and never get a tax deed.

Take the guesswork out of it and hire legal counsel with over 45 years combined experience!

Don't wait for the tax sale auction, call us today. 219-661-9100